Achievements

- Serving The Poor, Honouring The Marginalised

- Empowering India's Amrit Peedhi

- Ensuring Farmer Welfare

- New momentum for Nari Shakti

- Advancing India's National Security and defence

- Infra at Speed and Scale

- India's Enduring Tech-Prowess

- India: A Global Economic Powerhouse

- Affordable, Accessible Healthcare For All

- Northeast India - A Growth Engine

- Ease of Doing Business

- Vishwamitra : A friend to the world

- Ease of Living For Middle Class

- Conserving Cultural Heritage

- Propelling LiFE Environment and Sustainability

Digital India is Easing Lives

2020-05-28 15:12:00

Technology plays a critical role in building equitable societies that treat their members in a just way. There is limited scope for inherent biases which ensures all citizens are treated at par, irrespective of other attributes. Almost five years back, when PM Narendra Modi launched the Digital India initiative, it espoused to achieve a novel trident that would eventually ensure ease of living to the last man in the queue. The vision was not just limited to equal treatment, it was to provide dignity to lives of the underprivileged and ensure they receive what is meant for them. From profuse leakages to moneylenders, there was a lot that could be solved for by way of a country-wide ambition to use technology for governance.

Hallmark of PM Modi’s Digital India was the Jan Dhan – Aadhar – Mobile i.e. JAM trinity that has transformed the economic and social landscape. Not only do 130 crore Indians have a digital identity through Aadhar, 38.35 crore people have access to the banking system and thereby to formal credit through Jan Dhan. 1,51,735 Gram Panchayats are connected through optical fibre which has opened fresh opportunities for those who otherwise faced geographical and social constrains. The Pradhan Mantri Gramin Digital Saksharta Abhiyan [PMGDISHA] has made 2,15,68,283 people digitally literate.

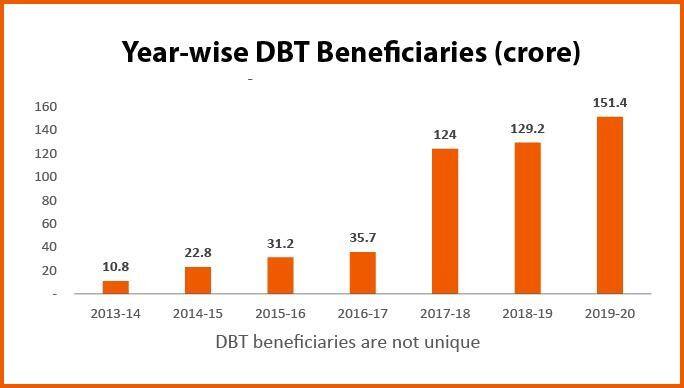

For several decades, plight of the common Indian was synonymous with serpentine queues of beneficiaries. Direct benefit transfer is yet another consequence on account of the JAM trinity. DBT has revolutionised the entire social security paradigm in India.

Source: https://dbtbharat.gov.in/

Even while presenting the Union Budget 2020-21, Finance Minister Nirmala Sitharaman mentioned that “Our Prime Minister has laid before us Ease of Living as a goal to be achieved on behalf of all citizens”. An amount of INR 3,958 was allocated to the Digital India mission in the budget 2020-21, an increase of 23% from INR 3,212 crore in 2019-20.

Balancing the Demand & Supply

It must be noted that the Digital India Mission was crafted to address both, the supply-side and demand-side challenges. To provide digital governance that would empower beneficiaries was not enough for the mission to meet its objective. Adequate infrastructure to be able to bear the espoused capacity levels had to be placed. From the privilege of a few, digital infrastructure is now treated as a public utility, one of them being access to internet.

⦁ Bharat Broadband Network Limited, an SPV with an authorised capital of INR 1000 crore was set up by Government of India to create National Optical Fiber Network (NOFN) in India.

The mission had to be people centric to ensure the rate of adoption of technology did not lag amidst the social conditioning. There were persistent nudges from the supply side to motivate demand, including seamless transfer of pensions and instalments of PM Kisan Samman Nidhi Yojana within days of announcement.

Access to formal credit through MUDRA was yet another incentive for consumers to shift their behaviour and embrace digital mode of banking. From an economy that was around 50% banked in 2014 to more than 80% in 2020, with almost 76% of PMJDY accounts linked to RuPay Cards, a staggering shift from the inherent reticence to participate in digital payment ecosystem is observed.

One of such examples is the digitally-enabled public grievance redressal systems.

Centralized Public Grievance Redress and Monitoring System (CPGRAMS) was digital platform launched in 2007 by UPA government. However, the public grievance cases were just 2 lakh in 2014. With trust posed by the citizens, in 2019 the received 18.7 lakh public grievances and disposed 18.1 lakh of them.

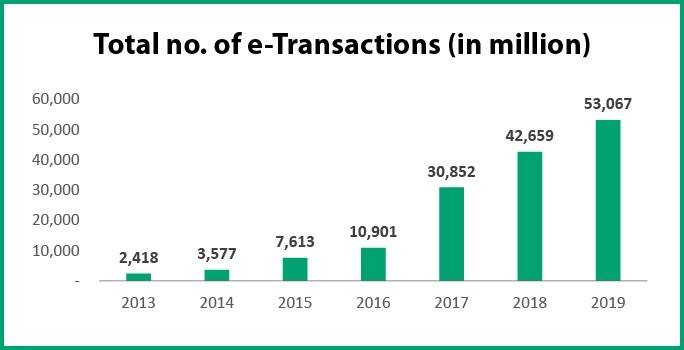

Online Transactions

Volume of online payments in 2014 was 4,620.9 million; In 2020, it was 24,511 million.

Volume of electronic transactions increased by 20 fold from 2013 to 2019.

Source: https://etaal.gov.in/etaal/YearlyChartIndex.aspx

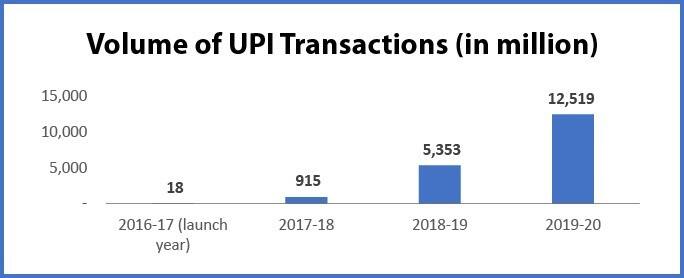

Waiver of MDR charges on UPI and RuPay debit card transactions to zero further incentivised cashless transactions, especially for merchants who otherwise preferred cash to avoid the additional fee. It is expected to be a force multiplier and bolster the FinTech industry that has been at the forefront of innovation for last-mile delivery of governance.

Source: https://www.npci.org.in/sites/default/files/RETAIL-PAYMENTS-STATISTICSApr-2020.xlsx

Multiple attempts were made by Governments and departments to increase the role of technology in India but they lacked a coherent vision. By acknowledging the potential of technology to transform lives across the length and breadth of society, digital India mission is not only empowering citizens, but also enhancing ease of living of the aspirational population.

More Articles

Ease of Living For Middle Class

मोदी सरकार के प्रयासों से मध्यम वर्ग को मिली नई उड़ान

June 7 , 2025

भारतीय मध्यम वर्ग लंबे समय से देश की आर्थिक, सामाजिक, और सांस्कृतिक विकास की धुरी रहा है। यह वर्ग हमेशा से सामाजिक एकता और सौहार्द को बढ़ावा देता आया है। दशकों से, इस वर्ग ने सामाजिक चुनौतियों और अनिश्चितताओं का सामना दृढ़निश्चय और साहस के साथ किया है। जहां पिछली सरकारें इस वर्ग की जरूरतों और मांगों के प्रति असंवेदनशील और उदासीन रहीं, वहीं प्रधानमंत्री नरेंद्र मोदी ने न केवल उनकी परेशानियों को समझा और स्वीकार किया, बल्कि परिवर्तनकारी नीतियों और सुधारों के माध्यम से उन्हें सक्रिय रूप से सशक्त भी

Ease of Living For Middle Class

इन्फ्रास्ट्रक्चर के बढ़ते मानक: मध्यम वर्ग के लिए सुगम जीवन की गारंटी

June 7 , 2025

भारत का मध्यम वर्ग अब सिर्फ संख्या और कमाई में ही नहीं, बल्कि अपनी उम्मीदों, सपनों और रोजमर्रा की जिंदगी के अनुभवों में भी बड़ा बदलाव देख रहा है। प्रधानमंत्री नरेन्द्र मोदी की सरकार की कोशिशों से 25 करोड़ से ज्यादा लोग गरीबी से बाहर निकलकर मध्यम वर्ग का हिस्सा बने हैं। इस बढ़ते मध्यम वर्ग की जरूरतों के हिसाब से अब सरकार, सेवा देने के तरीके और शहरों की योजना भी बदली जा रही है। मौजूदा सरकार ने एक ठोस और बहुआयामी योजना के अंतर्गत अच्छा भौतिक और डिजिटल इन्फ्रास्ट्रक्चर तैयार करने की दिशा में काम कि